50Y Progress Index

A Treasure Map for Founders

Our lives are unfathomably better today than they were just a century ago thanks to breakthroughs in energy, materials, bioengineering, transportation, computation, communications, and more. This progress defines modern life. How we commute, how we communicate, and whether we’re healthy are defined by technological breakthroughs.

These transformative innovations have led to more abundance. Food, energy, and aluminum are 80-90% cheaper than in the late 1800s, air travel is 7X cheaper than in 1950, computing is 10 trillion times cheaper per calculation than in the 1940s, and communication is 10 million times cheaper per megabyte than in the mid 90s.

But in startup land, a huge percentage of people are now focused on progress within the same few small areas, like SaaS or low-code dev tools. This overconcentration comes at an enormous cost: brilliant people who could build the next massive leap forward are instead grinding out incremental innovations that others would have soon found. For example, the number of startups competing for customers in a single $50B market can vary by a factor of almost 1,000!1 We wondered what a modern treasure map would look like, but for startup opportunities.

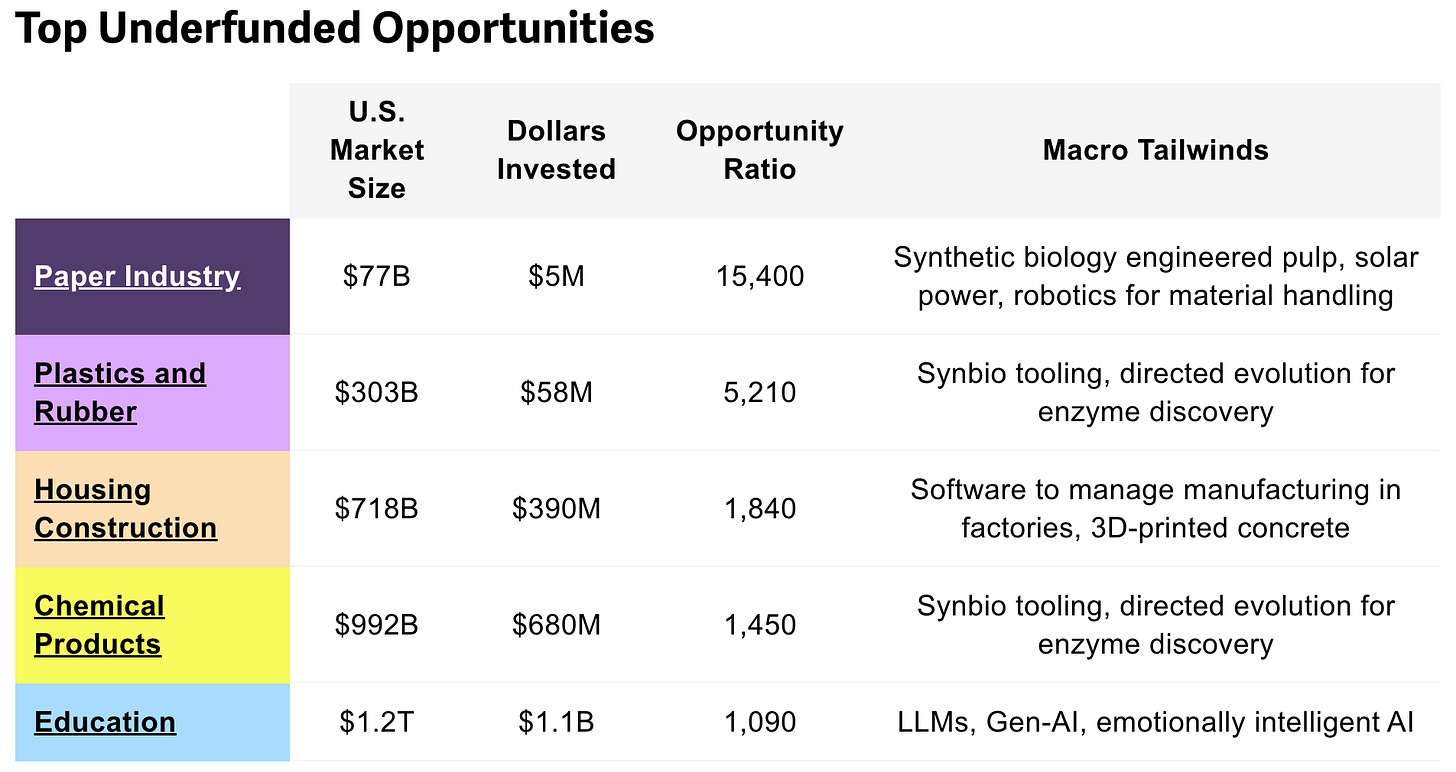

To answer that question, we’re launching our first attempt at the list of Top Underfunded Opportunities: massive markets with little startup investment and ripe conditions for disruption. Based on our analysis, we selected five – sometimes counterintuitive! – progress areas based on their Opportunity Ratio: the U.S. market size divided by the total invested in startups in that market, as well as any key enabling technologies or macro tailwinds.2 Here’s what the numbers tell us:

Let’s talk about the (paper) elephant in the room. The top opportunities on this list were counterintuitive, even to us! Coming in at a ratio of $15,400 of spending for every $1 invested is paper products. It turns out that we buy a lot of paper: from disposable tissue paper, toilet paper, and paper towels, to the cardboard used to ship every ecommerce delivery. Very little has been done to imagine better forms of paper or better ways to make paper than (slowly) growing trees, chopping them down, and then squeezing them into thin sheets. What if we could use bioengineering to grow paper directly, without the trees? It could be a big win for energy efficiency, land use, the environment, and the entrepreneurs & scientists who figure it out. You can tell similar stories about the potential for reimagining other top opportunities on our list, like plastics, chemicals, housing, and education.

Paper might not seem sexy but improving the methods of production of paper would be a huge deal. It might seem odd for a hard tech investor like 50Y to be highlighting the unusual ratio of spend to startup investment in the paper industry, but the numbers don’t lie!

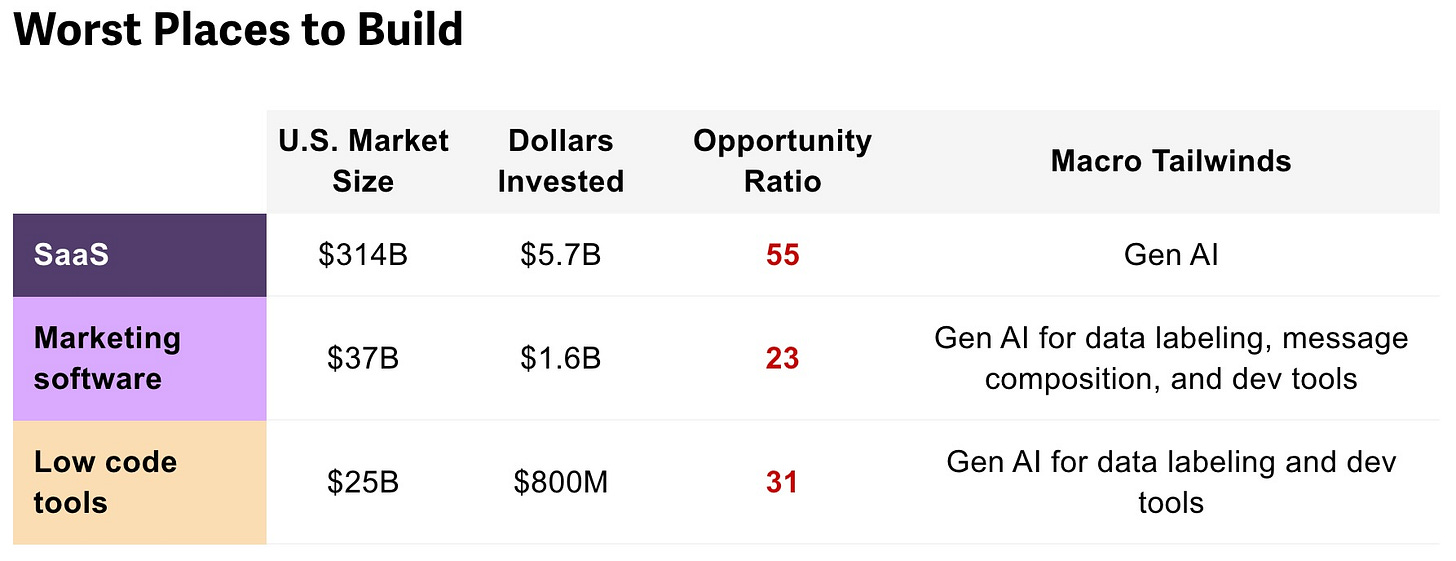

Besides sharing some top opportunity areas, we’re also highlighting a few where the ratios are particularly bad. These are oversaturated markets where many founders fail by competing to solve low impact problems in similar ways.

The overconcentration of startups working on SaaS, marketing software, and low-code tools leads to low opportunity ratios. Even if you expect a new startup solution to outperform others and these industries to grow rapidly, the resulting impact on the economy would be comparatively very small.

The full Treasure Map of opportunities is much bigger and we hope to share more about it soon, as well as many open source datasets that our community has helped to gather along the way. This is a rough first pass at quantifying high-leverage areas to build. If you’re interested in exploring counterfactual opportunities like these or contributing to the Progress Index effort, sign up to be the first to hear when we post the full map!

At Fifty Years, we’re long-term optimists backing breakthrough founders. The 50Y Progress Index is our attempt at assessing how technology can shape the next fifty years. We believe that progress compounds and technology, thoughtfully stewarded, can uplift the prosperity of all.

Ask us about the Fifty Years company building in an underexplored $1T space that already has 10s of millions in revenue. 😉

A note on the methodology: we searched databases for startups founded in the last 6 years that raised $5M or more. We also analyzed total capital invested in companies founded in the last 10 years to get a sense for how much capital has been invested in certain markets. This is our first iteration of this approach, and we’d love your suggestions and feedback on how to better structure this.

Very interesting analysis! Would be interesting to re-run an analysis like this for carbon-related technologies, in the style of Project Drawdown

This is great. Makes me want to start a paper company. Just a curiosity, is the $5M threshold meant to capture post-Series A companies? Thinking this would be really useful in my corners of health tech, but would likely want to include the $2m to $5m range seed checks. Thanks again, loved the post.